With Amazon Net Companies Inc.’s annual Invent convention simply across the nook, the highlight as soon as once more falls on Amazon.com’s Inc.’s cloud computing firm and its dominance of the general public cloud — and this 12 months’s occasion comes at a vital time.

As the general public cloud enters the Cloud 2.zero period, the speak is not about “digital transition,” however fairly “digital transformation,” or the end-to-end modernization of enterprise data expertise. Cloud 2.zero is altering the sport, with new architectures pushed by knowledge, machine intelligence and cloud at scale, resulting in unprecedented innovation and the creation of fully new firms and enterprise fashions.

However simply how pivotal a task is AWS enjoying on this transformation? And the way do its opponents, each within the cloud and in legacy IT, stack up? These are the questions Dave Vellante, chief analyst at SiliconANGLE sister market analysis agency Wikibon and co-host of SiliconANGLE’s video studio theCUBE, makes an attempt to reply in his newest Breaking Evaluation video.

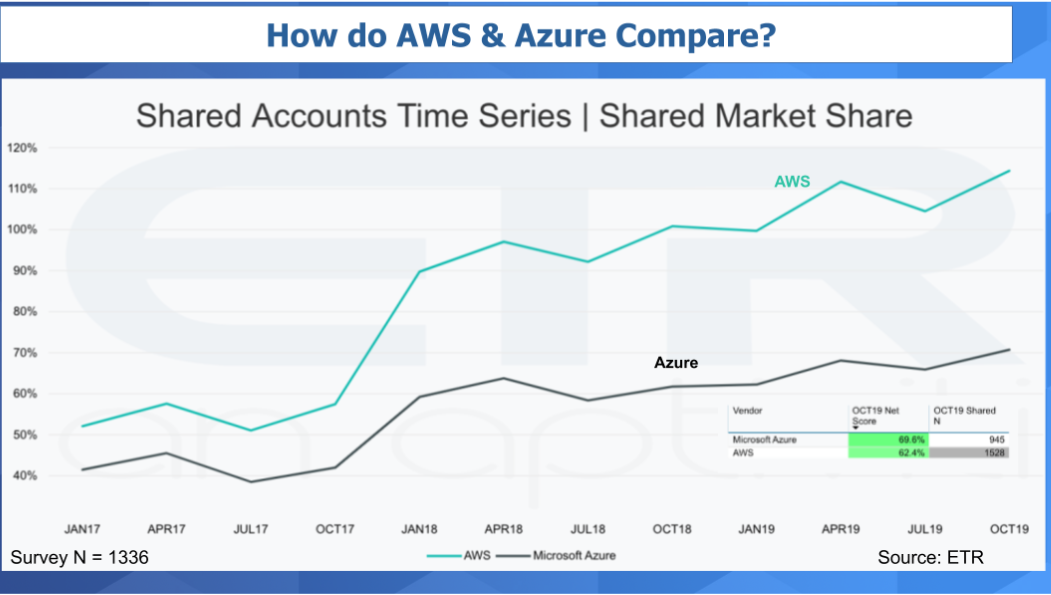

One of the vital dependable methods to match data expertise suppliers is to take a look at the place the spending motion is, and as Vellante factors out, a fast look on the newest knowledge from Enterprise Expertise Analysis exhibits us that the entire main cloud suppliers are seeing some robust momentum in that regard.

ETR’s knowledge exhibits us that AWS is clearly nonetheless rising quick and it stays the largest cloud participant. Different market knowledge from Wikibon and varied third celebration sources present that AWS’ infrastructure-as-a-service enterprise final 12 months was about three time bigger than that of Microsoft Azure. Nevertheless it’s notable that its lead is slowly being eroded by Microsoft, whose Azure cloud enterprise is rising at a a lot quicker clip.

“Microsoft is closing the hole,” Vellante stated. “The Wikibon crew assume AWS will are available in at $35 billion this 12 months. And so they have Microsoft’s IaaS enterprise at round $15 billion, or 43% of AWS’ enterprise. So you may see Microsoft is catching up.”

That could be so, however AWS additionally enjoys a powerful place in a few of the most necessary sectors within the cloud, which suggests it’s unlikely to be unseated from its high spot anytime quickly.

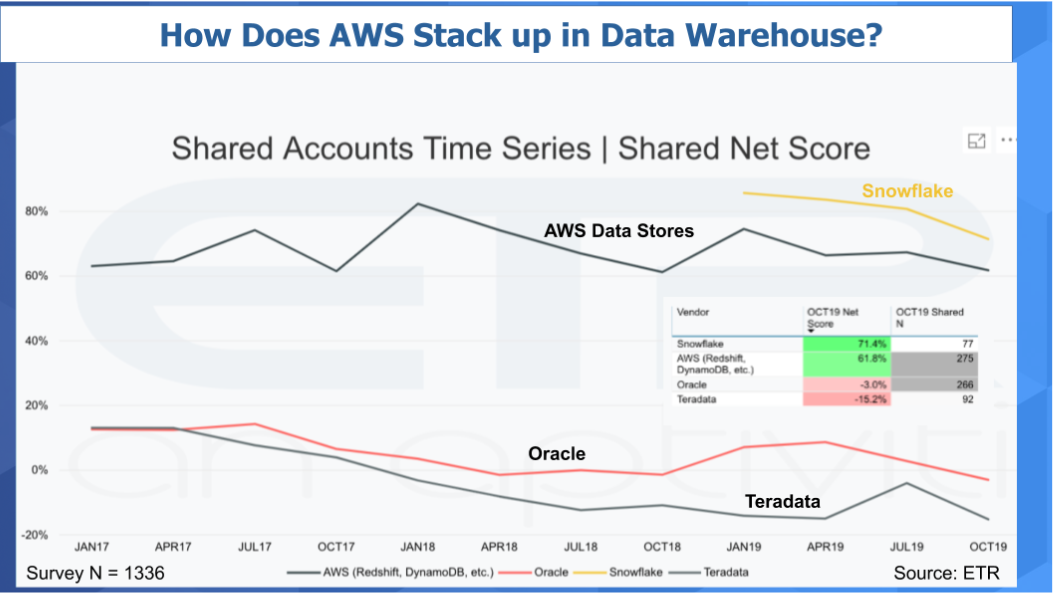

One in every of AWS’ greatest strengths lies in databases, significantly knowledge warehouses, which mixture structured knowledge from a number of sources so it may be in contrast and analyzed for enterprise functions. ETR’s knowledge exhibits that Amazon’s Redshift achieved a powerful web rating, which is a measure of spending momentum, of 61.8% within the final quarter.

Notably that places it behind Snowflake Computing Inc.’s Snowflake knowledge warehouse, which had a web rating of 71.4% within the final quarter, nevertheless it’s additionally manner forward of legacy firms akin to Teradata Inc. and IBM Corp. These “outdated guard” companies as soon as dominated the sector however now discover themselves coping with unfavorable web scores, which suggests enterprises are spending much less cash on their merchandise than they did earlier than.

“You may see the traditional innovator’s dilemma at play right here the place AWS and Snowflake are within the inexperienced and the legacy gamers are firmly within the purple,” Vellante stated. “However there’s one thing new occurring within the cloud, with a brand new development rising that’s driving new workloads. All this knowledge now sits within the cloud and clients are utilizing knowledge shops like Purple Shift and Snowflake to get extra insights out of that knowledge. They're bringing instruments like Databricks to the equation and driving a complete new set of workloads that aren't nearly provisioning infrastructure however fairly extracting insights rather more shortly from knowledge.”

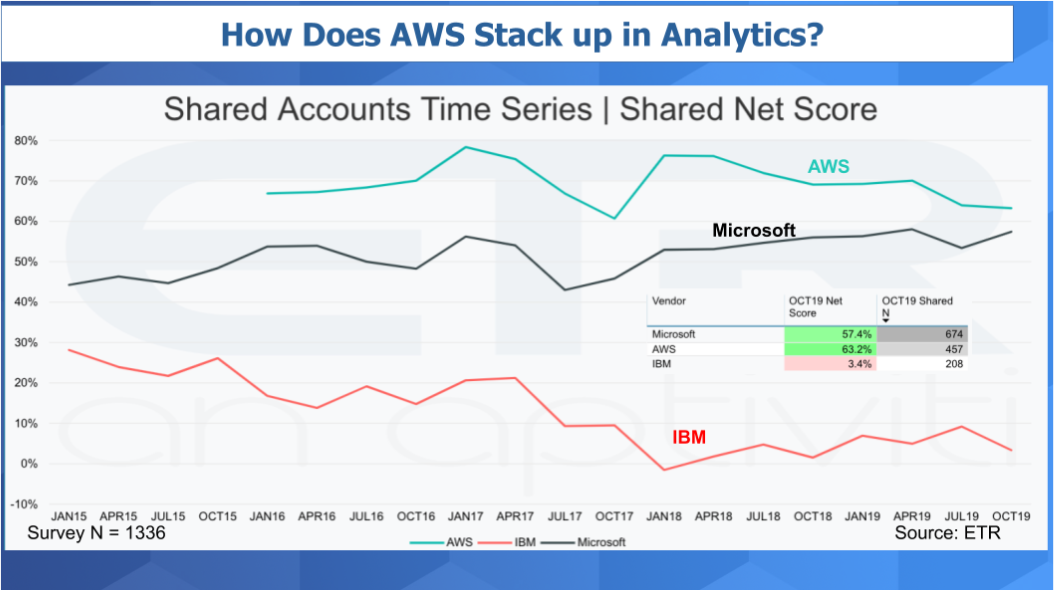

Comparable traits are occurring in different key sectors of the cloud too, Vellante stated. For instance in analytics, each AWS and Microsoft Azure are trying very robust, as soon as once more gaining market share on the expense of legacy companies.

“I’m not making an attempt to choose on the legacy gamers, however I believe it’s necessary to supply context,” Vellante stated. “And in terms of spending momentum the info doesn’t lie. IBM has a large and spectacular set of capabilities within the analytics house however you may see the place patrons are putting their bets.”

AWS and Azure are additionally just about neck-and-neck within the synthetic intelligence and machine studying enviornment, with significantly extra momentum than IBM Watson, for instance. And it’s a lot the identical story with software program containers and capabilities, the place Amazon’s Lambda and Elastic Container Service each get pleasure from optimistic web scores with regard to spending, placing them forward of Pivotal Software program Inc.’s Cloud Foundry, for example.

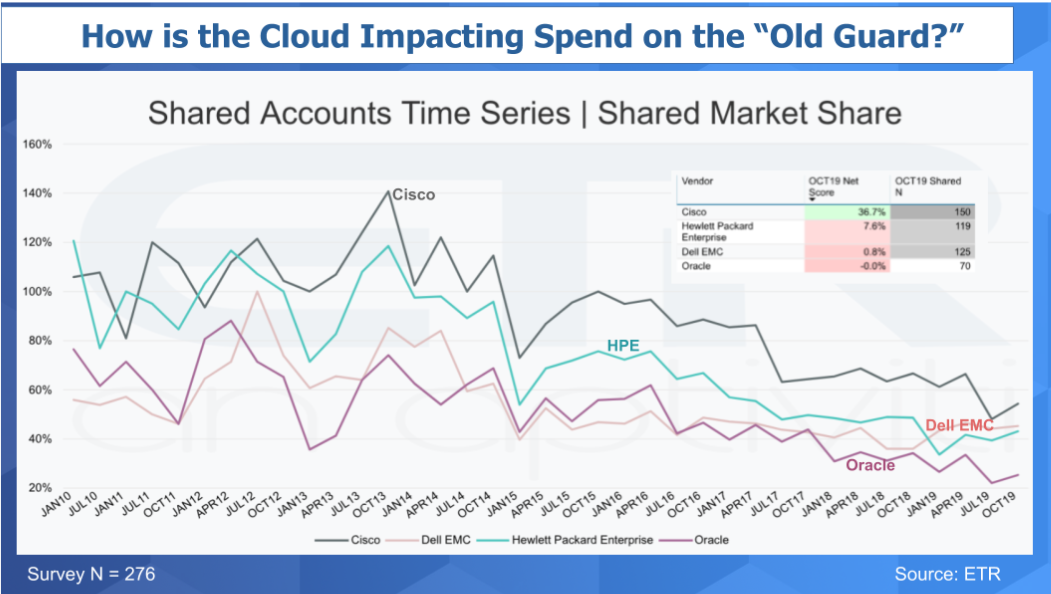

The outdated guard, in the meantime, is clearly feeling the pinch, as extra money being spent on the cloud inevitably implies that much less goes towards their legacy services. The next graph exhibits how spending on conventional IT firms has slowly declined during the last decade.

“The story is obvious,” Vellante stated. “Popping out of the downturn in 2010 the large legacy guys who had been holding their breath got here up for air and noticed numerous pent-up demand. However the cloud has continued to slowly eat away at their share and their spending momentum as seen by the web scores within the desk.”

Vellante famous that networking big Cisco Methods Inc. is the one exception with a reasonably robust web rating of 37%, however that’s primarily as a result of the corporate’s heritage means it’s in a very good place to attach and safe knowledge transferring throughout clouds. Nonetheless, he stated the proof means that the cloud’s lengthy and regular march will solely proceed within the path it has been going. And AWS, he contends, will certainly be on the forefront.

“Cloud 2.zero is right here and it’s getting extra complicated,” Vellante stated. “The so-called outdated guard is hanging onto its put in bases however in some ways is working laborious to get less complicated. Will these two domains — the cloud-native and the cloud wannabees — attain an equilibrium of types? Not functionally, however there are numerous alternatives for the massive whales to capitalize on a consolidating business and compete.”

Right here’s Vellante’s full evaluation:

Predominant picture: AWS/Fb

Because you’re right here …

Present your help for our mission by our 1-click subscribe to our YouTube Channel (under) — The extra subscribers we now have the extra then YouTube’s algorithm promotes our content material to customers involved in #EnterpriseTech. Thanks.

Assist Our Mission: >>>>>> SUBSCRIBE NOW >>>>>> to our Youtube Channel

… We’d prefer to inform you about our mission and how one can assist us fulfill it. SiliconANGLE Media Inc.’s enterprise mannequin is predicated on the intrinsic worth of the content material, not promoting. In contrast to many on-line publications, we don’t have a paywall or run banner promoting, as a result of we need to hold our journalism open, with out affect or the necessity to chase visitors.The journalism, reporting and commentary on SiliconANGLE — together with stay, unscripted video from our Silicon Valley studio and globe-trotting video groups at theCUBE — take a whole lot of laborious work, money and time. Protecting the standard excessive requires the help of sponsors who're aligned with our imaginative and prescient of ad-free journalism content material.

When you just like the reporting, video interviews and different ad-free content material right here, please take a second to take a look at a pattern of the video content material supported by our sponsors, tweet your help, and hold coming again to SiliconANGLE.

0 Comments